I went to the dentist the other day. That usually is not a pleasant experience. However, I’m blessed with pretty good teeth. A long time ago my father told me to take care of my teeth, because if I didn’t it would be very painful at some point in the future.

So from that moment on, I brushed and flossed like it was 1999. After that year went by, I kept going. Year after year went by and my dentist said my teeth looked great. Then my dentist retired and I dithered for a while and then signed up with my former dentist’s son. Luckily for me, my former dental hygienist was working for him. My teeth, after all that time have a lot to be thankful for.

However, having pearly whites hasn’t been a pleasure cruise. Every four to six months I get my teeth cleaned. That’s where I don’t get it. My hygienist puts all of these very sharp objects into my mouth and grinds and scrapes away. A couple of years ago she put this new variable speed grinder in my mouth, which redefines the word “scraping.” As it swirls in my mouth it seems my teeth are going to pop out and land in a cup. However at the end of the session, I always seem to survive and I get the peace of mind that all is well with my teeth.

So I continue to live on the dental edge, brushing up a storm and hoping for the best. Still, my record is pretty good; over time I’ve not had a lot of trouble. Yes, I know it’s a stretch, but that’s something like our good old Canadian economy. With the good times rolling over the last couple of years, and with the unemployment rate under 6%, its like our economic gods have been flossing their widgets.

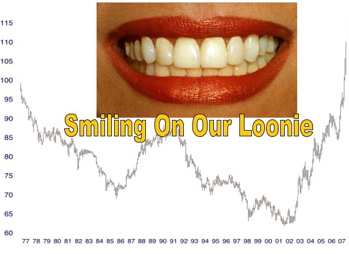

I get a kick out of the cavity laden high priced economists who are currently predicting the Bank of Canada will be reducing interest rates at its first opportunity. Even the loonie has calmed down a bit with the spectre of an interest rate cut. It seems to make good sense; the Canadian economy is bound to slow down so let’s cut rates. Let me remind you that many of these same economists were saying the loonie was headed to 78 cents US after it briefly broke under 85 cents US last January. When it hit $1.1009 last November 7th, I wonder where they were.

Hopefully they were getting some of their teeth pulled by some green horn dentist. In fact extracting any type of retraction from a group of economists about the value of our loonie in January 2007 is like telling a gaggle of gooses to go feed the pigs. There are always other economic priorities, which come along to alter the path to the pig trough.

That doesn’t mean our dismal scientists are a bunch of bad people. It means like so many Canadians they didn’t see the US greenback drop down to record levels. In fact the US dollar index, which is a measure of the US greenback against a basket of currencies is at its lowest level in modern history. The loonie responded accordingly. Nobody, and I mean nobody in Canada had a $1.10 loonie in their business plan.

Of course we know the rest of the story. Farmers, manufacturers, exporters and others are losing their shirts based on the super charged loonie. However, how about that dental bill of mine? It hasn’t changed in at least three years. Is that a good thing? Yes, it is, but with the loonie being worth about 30% more than 3 years ago, doesn’t that mean the dental shop has 30% more purchasing power? Doesn’t it mean the dental shop got a big raise and I didn’t? Get the picture what is resonating across the Canadian economy.

The pressure is clearly on the Bank of Canada to do something to make things better. Interest rates are always the hammer, so we’ll see what happens. I’ll be particularly interested because in December I’ll be in Grande Prairie Alberta for a speaking engagement. That’s ground zero of why our loonie is so high, our interest rates are low and my dentist has 30% more purchasing power than he had three years ago. Yes, blame it on Alberta.

However, that wouldn’t be quite fair. Someday soon oil prices will cut a fierce retreat and so will our loonie. Alberta oil won’t seem so exotic and the American greenback will catch some wind. Then the Bank of Canada will cut interest rates. It’ll be just like going to the dentist. They won’t really want to, but at the end of the day it’ll be the right thing to do.